Dark Crypto Currency: Understanding the impact of Transactions Compensation on Your Earnings

Crypto currency has revolutionized a way of thinking about transactions and financial transactions in general. With the increase in digital currencies, such as Bitcoin, Ethereum and others, investors and traders have managed to use new investment opportunities that have been unavailable before.

However, one of the biggest challenges facing investors are cryptocurrencies are transactions. Transactions for transactions are charged by exchange of cryptocurrencies to process transactions in the blockchain network. These fees can be of a few cents for hundreds of dollars for trade, which interfereses both beginners and experienced merchants to make a profit in this space.

What causes transactions for fees?

Transactions for transactions are caused by several factors, including:

- Network overload : When there are more transactions in the blockchain network than they can be processed in real time, the fees become necessary to encourage miners to confirm new blocks of transactions.

- High computer power is required : new locks require significant amounts of computer forces to solve complex mathematical problems and create an important bloc chain. As the number of users increases, a computer force is required, which leads to higher transactions fees.

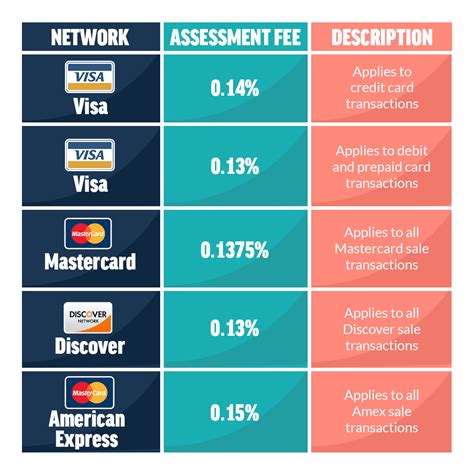

- Centralized replacement fees : When traded centralized stock exchanges (CEX), fees may be higher than the fees calculated by Peer-to-PEER (P2P) replacements.

- Committees for exchange : Some stock markets charge for additional services for services such as shopping and sales, payments and deposits.

Influence of transaction fee on profitability

Transaction fees have a significant impact on profitability in the CRIPTO currency space. Here are some reasons:

1.

- Growing commercial costs : higher transactions fees can lead to increased commercial costs, reducing the attraction of investment in the Crypto currency.

- Limited liquidity : lower transactions can limit the number of transactions that can be executed at the same time, additionally limiting liquidity and disrupting the CRIPTO currency trade.

How transaction fees affect different trade strategies

Transaction fees may affect different trade strategies, including:

1.

- Trade Day : Short -term merchants are often aimed at exploiting market fluctuations and may have less influence on transactions.

- SPECULED SHOP **: Merchants involved in speculative activities, such as buying low and sales, may be harder to achieve profit due to higher costs associated with transactions compensation.

Transaction fee reduction

To alleviate the impact of transactions on your profit, consider the following strategies:

- Use P2P Replacement: Replacement Peer-to-Peer can often charge lower fees than centralized exchange.

2.

3.

app

Transactions fees are a significant obstacle in the CRIPTO currency space, which affects profitability and trade strategy. Understanding the reasons for transaction fees and their impact on various trade strategies, investors and traders can make informed decisions regarding their investment.