“cryptocurrency trading with secure lever effect: exploration of the DAO curve and isolated margin”

While the cryptocurrency world continues to evolve, traders are looking for ways to manage risks while benefiting from high frequency negotiation possibilities. Two popular solutions that have gained significant traction in recent years are the DAO curve (CRV) and isolated margin trading.

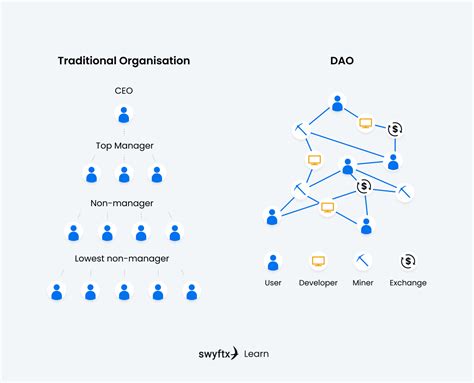

Curve Dao: a decentralized loan platform

Curve Dao is a decentralized loan platform that allows users to lend their cryptocurrencies to others, which earns interest in their assets while providing liquidity to the market. The platform uses a unique “stable” token, known as CRV, which serves both as a guarantee and funding for its loan protocols.

One of the main characteristics of the DAO curve is the focus on security and decentralization. The entire protocol is built on blockchain technology, ensuring that all transactions are transparent, immutable and unforeseen. This level of security has made Curve Dao a popular choice among traders seeking to minimize their exposure to risks while participating in high -frequency negotiation opportunities.

Isolated margin trading: a high -risk strategy

Isolated margin trading, also known as “isolate” or “autonomous”, is a high-risk strategy that involves using a separate portfolio and an account for cryptocurrencies. This approach allows traders to lock their funds from the main account, reducing exposure to market fluctuations.

Isolated margin trading works using a combination of stop controls and end stops to limit losses. The trader can set a target profit or loss objective and automatically adjust its position according to price movements. This strategy requires a high level of technical expertise and discipline, but offers the potential for significant profits on volatile markets.

Key advantages of the DAO curve

- Risk management

: The Curve Dao isolation function offers traders an additional layer of protection against market fluctuations.

- Liquidity provision : The platform guarantees that liquidity is always available to support high frequency negotiation opportunities.

- Stablecoin : CRV serves as a stablecoin, providing an active ingredient for investors seeking to minimize volatility.

Key advantages of isolated margin trading

- Reduced risk

: Using an isolated wallet and account, traders can considerably reduce their exposure to market fluctuations.

- Improved control : Traders have complete control over their professions, allowing them to manage risks and optimize yields.

- Higher yield potential : Isolated margin trading offers higher yield potential due to the capacity to lock the markets in market volatility.

Conclusion

Curve DAO and isolated margin trading offer two separate approaches to manage the risk of cryptocurrency on the markets at the rapid rate of today. While Curve Dao provides a secure and decentralized solution, the isolated margin trading offers traders the possibility of reducing the risks while participating in high -frequency negotiation opportunities. While the cryptocurrency world continues to evolve, it is essential for merchants to remain informed of the latest developments and strategies at their disposal.

Whether you are a seasoned or new merchant in the world of cryptocurrency, we hope that this article has provided valuable information on the DAO curve and isolated margin trading. Do not forget to always do your own research and consult financial experts before making investment decisions.